Ms Legalista is a blog to help people keep their hard-earned money in their pockets and out of the hands of scammers. It is a product of Shelia A. Huggins, PLLC, a North Carolina licensed law firm. This blog contains links to affiliates. If you purchase something through one of those links, Shelia A. Huggins, PLLC may receive a commission.

Seriously, sometimes we don’t learn about the tricks until we start using the freemium version of these online products.

Here’s the case summary from the Federal Trade Commission:

The Federal Trade Commission is taking action against tax preparation company H&R Block for unfairly deleting consumers’ tax data and requiring them to contact customer service when they downgrade to more affordable online products, and deceptively marketing their products as “free” when they were not free for many consumers. These practices cost consumers time and money.

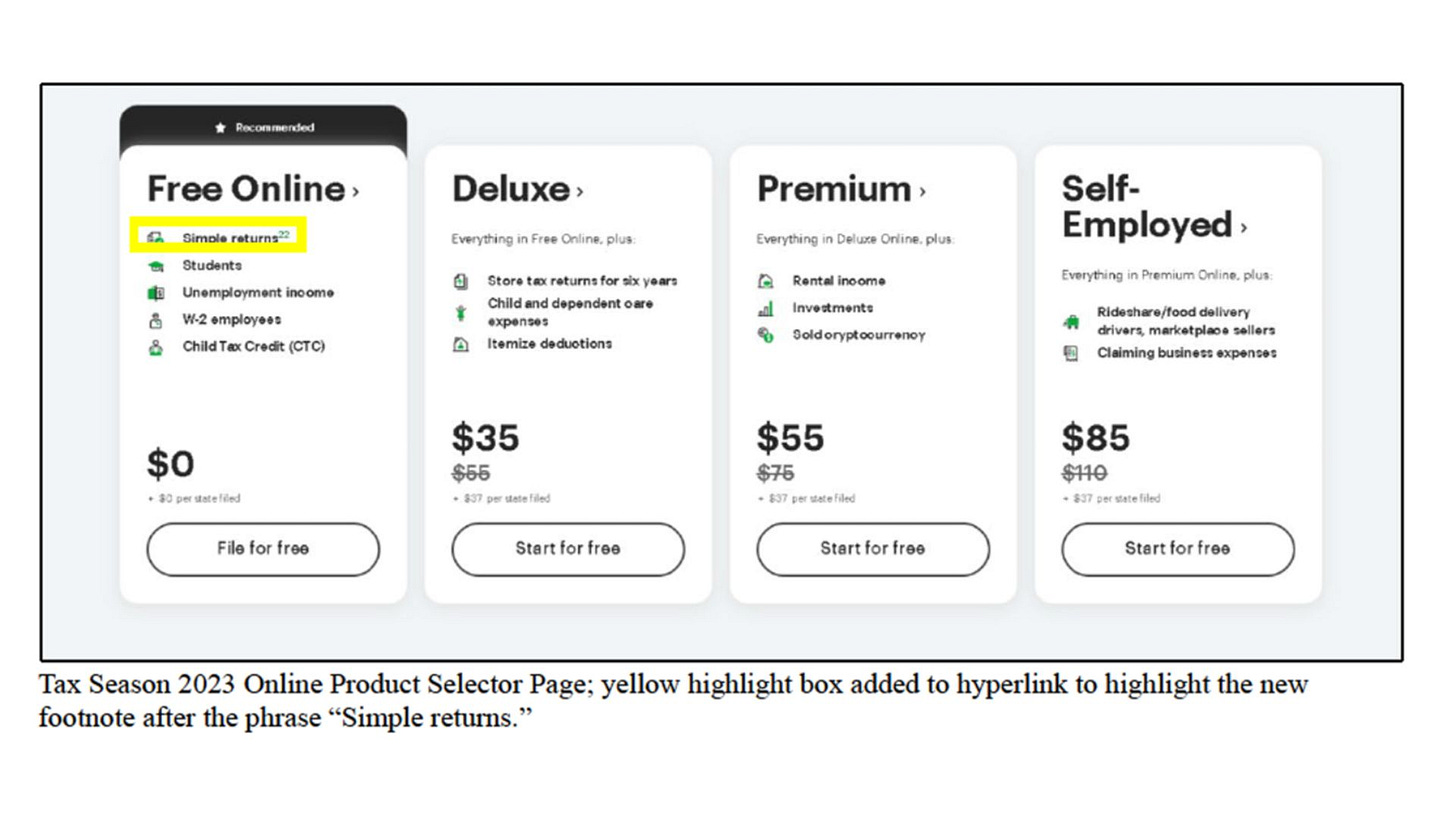

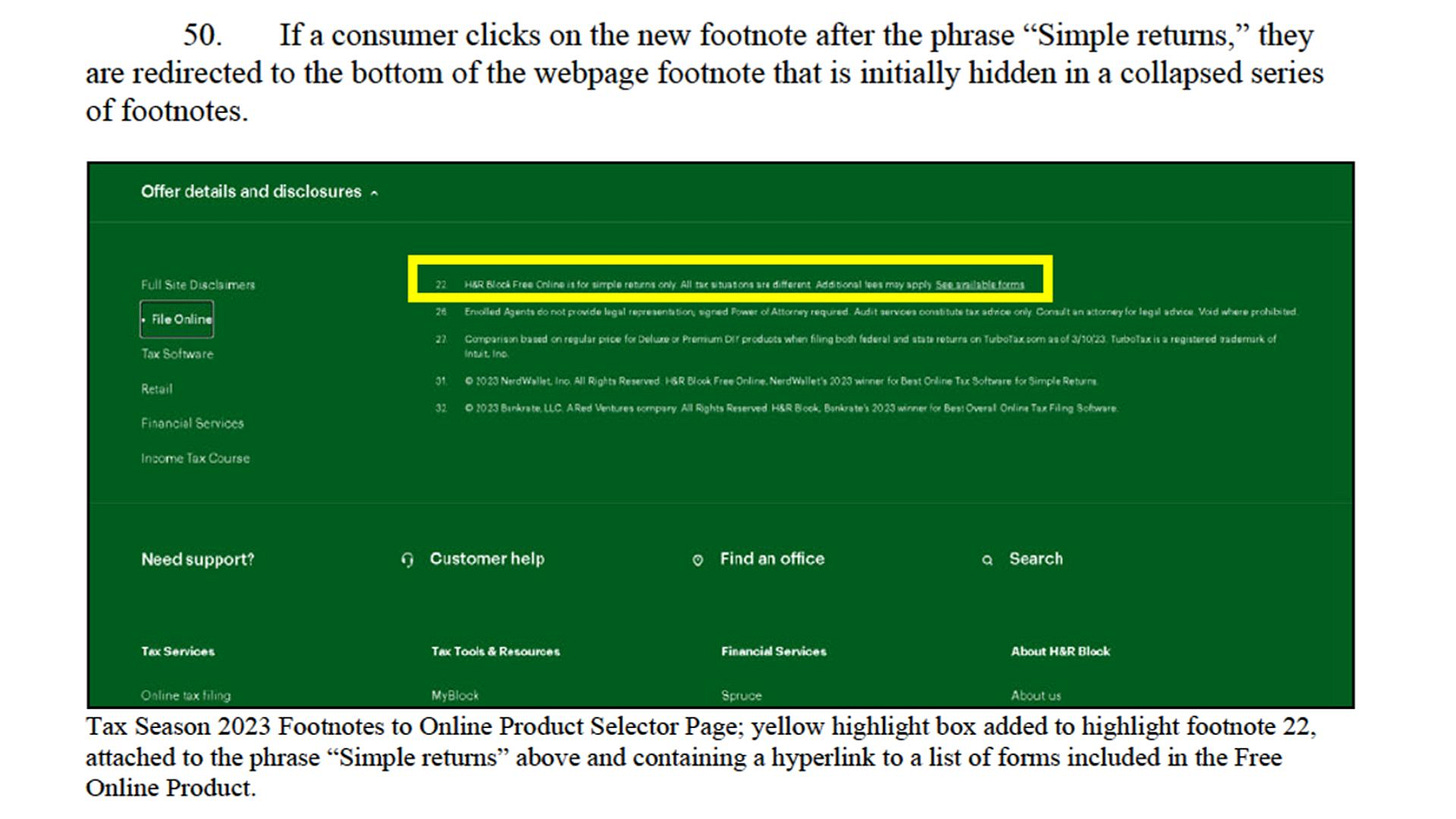

Specifically, the FTC took issue with H&R Block’s failure to let people know what “simple returns” where.

Basically, you would start using the product, not knowing that this was a product you were not going to be to use. . .up front.

But, there’s more.

This was really about how H&R Block hid information in order to coerce customers into purchasing more expensive products.

Personally, I use TurboTax, and I believe that TurboTax likely had some of the same issues. I would frequently find that it was hard to determine which version of the product I needed to buy.

I also ran into issues when I would start working on my taxes before logging into my TurboTax account. It was almost like you had to start completely over.

Here are three things you should watch out for if you choose to use tax preparation software.

1. Phishing Emails or Fake Websites

How It Works:

Scammers send fake emails or set up fraudulent websites that mimic legitimate tax software providers, asking you to log in or provide personal information. These phishing attempts aim to steal your credentials or financial data.Red Flags:

Emails with typos or generic greetings like "Dear Customer."

Links directing you to websites that don’t match the official tax software URL.

Requests for sensitive information like your Social Security number or bank details via email.

How to Avoid It:

Always go directly to the official tax software website instead of clicking on links in emails.

Look for "https://" and a padlock symbol in the browser when accessing tax software sites.

2. Fake Tech Support Scams

How It Works:

Scammers impersonate the tax software's customer service, either by phone or through fake ads online, claiming you need to fix an account issue or download updates. They may ask for remote access to your computer or request payment for unnecessary services.Red Flags:

Unsolicited calls or messages claiming to be from your tax software provider.

Pressure to act quickly or threats about account deactivation.

Requests for remote access to your computer.

How to Avoid It:

Contact customer support using the official number on the tax software’s website.

Never allow remote access unless you’ve verified the support team’s legitimacy.

3. Refund Scams

How It Works:

Scammers claim your tax software over-calculated your refund and ask you to "repay" the extra amount. They may contact you pretending to be from the IRS or the software provider, often citing errors in your filing.Red Flags:

Unsolicited calls or emails about refund discrepancies.

Requests to pay back money using gift cards, cryptocurrency, or wire transfers.

Messages creating a sense of urgency to resolve the issue immediately.

How to Avoid It:

Verify any refund discrepancies directly with the IRS via their official channels.

Know that legitimate tax software providers don’t handle refunds; only the IRS does.

Stay Safe:

Always use tax software from reputable providers, ensure you’re on the correct website, and remain vigilant about unsolicited communications. When in doubt, contact the software company or the IRS directly to confirm any issues.

*****

Credit: Read the FTC Complaint.

Thanks for reading and watching.

Let me know your thoughts.

You can also watch more of my videos on my YouTube channel.

Hey, if you’re not ready to subscribe, consider tipping $1.00 to support the blog.

Ms Legalista is a blog to help people keep their hard-earned money in their pockets and out of the hands of scammers. It is a product of Shelia A. Huggins, PLLC, a North Carolina licensed law firm. This blog contains links to affiliates. If you purchase something through one of those links, Shelia A. Huggins, PLLC may receive a commission.

Running into an issue you need to discuss. Get a consultation for $79. Schedule now.

Need a short document reviewed. Get answers before you sign. Schedule a review.

We now have a merchandise store at Fourthwall.

Want to stay up to speed with the latest videos. Subscribe to the YouTube channel.

Check out my affiliates.

Start your own Fourthwall merchandise store.

Get a free month of Skillshare, and learn more now.

Get your 30-day free trial of Home Title Lock.

Share this post